This week, Clare Seal joins us to talk about her experience around loans, her own work around financial literacy and her new books. We speak about Claro’s risk quiz – if you’d like to try it, click here.

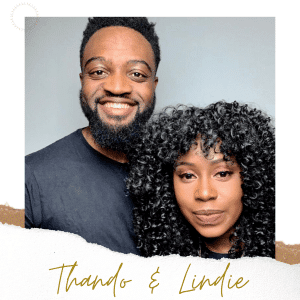

Abdul: Hi, I’m the Community and Social Media Manager here at Claro. Today, I have a special guest who will be joining us shortly. But if you’re new to Claro, we’re a digital financial coach and community helping people make better smarter financial decisions. So I think I see Claire joining us now. Hi. How are you doing?

Clare Seal: Yeah, good thank you! I’m sitting on these homemade Pokemon cards that my son made.

Abdul: Anything to keep us entertained right now! I’m there for it.

Clare Seal: Yeah, I think I should give you guys a close-up view of one, they’re quite something.

Abdul: Well, if you are joining us on our live, and I think most people will know Clare, but please give us a quick introduction to who you are?

Clare Seal: Yeah, so I’m Clare Seal and I’m the person behind @myfrugalyear ‘s Instagram account. It was anonymous for just over a year because it was discussing some quite big themes around money. I think one of the things I’ve really tried to do is to try and remove some of the stigmas around making mistakes with money and accruing debt or failing to save all of those things. And you know, and that’s not something that we talked about lightly. So I was anonymous for a year, decided to sort of revealing myself earlier this year, and the response has been like, just lovely. I’ve also written two books, one of which real-life money came out in May. And the second is follow up, it’s journal the fit in yourself. We started December, so yes, sort of potted history of me.

Abdul: Well, congratulations on your book releases, that’s super exciting! And I think kind of similar to what you’ve been talking about what we’re doing at Claro is really trying to showcase different (with this series in particular) different financial journeys. I think it’s important for people to understand there’s no one way and no quick fix for anything. So my first question is what are your current financial goals?

Clare Seal: So, I mean, at the moment, there are a few different strands. The first is to finish paying off our debt. I started @myfrugalyear because I had this really broken relationship with money for a long time. And it has resulted in just over 27 grand of credit card overdraft debt. Paying that off was a big reason. I mean, it was the reason why I started the account. I felt I might get a couple of dozen followers, that might attack me if I buy too many lattes and I didn’t expect any of this to happen.

So we’ve paid off this debt of just over 70 grand. We’ve got a little bit left to go on. But obviously, as anyone who has a debt with interest knows, the more you paid off, the less interest you’re paying.

Beyond that, it’s saving for a house deposit. We still rent but we’re a family. We’ve got two young children. And I think for a lot of us the kind of precariousness of renting. We had to move earlier this year because landlords suddenly decided to sell even though they told us they weren’t going to. I think just having control over where you live is a really big thing for us. So that’s our next big goal. But I’m also trying to think sort of further into the future about retirement and investment and all of the things I scared to even think about when I was in the midst of this really like horrible push and pull relationship with money.

Abdul: Yeah, that sounds good. I think he mentioned something about retirement there as well. So the next question was actually, with these goals that you have, and what kind of timelines do you see for this? And how you kind of going about making sure that you kind of reach those goals, which is a hard question but is there anything you’ve got in place?

Clare Seal: I think it’s hard to have super long term goals, it’s good to have a vision for what you want your life to be like. And then you can decide how you’re going to use money as like a tool to get there. I’m very passionate about this feeling that you know, the goal shouldn’t be the money, the goal is what you use the money for. That means that for everybody, they’re going to have a different earning target and a different amount that they want to have saved. It’s very personal. But for me, I think, I’d really love it if we were living in our own home within the next three to four years potentially.

I think in terms of retirement, my career has changed so much. I was kind of a full-time employee, as a brand manager up till last summer, summer 2019. And now I’m freelance and this really squiggly career where like, write books, sometimes I work with brands and do some social media stuff – all of that. And so I don’t know, when I’m gonna want to sort of, you know, have to have for money when I’m not working. But I would like to just make sure that I have this kind of financial stability and peace of mind by my mid-30s. If I could retire by sort of 60 -65, I think that’ll be quite nice.

Abdul: That’d be a dream. But I think obviously, it’s quite tricky, like you said for certain goals and timelines, as they are super-specific to you as an individual? But are you doing anything in terms of your allocation? Are you making sure that you are putting certain amounts to a certain pot or into a pension? Like, how are you going about that?

Clare Seal: Yeah. I am just starting to pay into a self-employed pension, I’ve got a couple. I think for a lot of people, we’ve got like a couple of different pension pots from previous jobs. And we’re not really sure what to do with them and all of that stuff. But I’m just starting to pay into a self-employed pension. I’m going to do some work on @myfrugalyear on that in the next few weeks. I did a poll and around 97% of people said ‘Yes, please explain pensions to us‘. So I’m definitely going to do something on that.

At the moment, I’m prioritising the debt that’s accruing a lot of interest, it feels like a sensible thing to do. I will say, I do have an emergency fund and trying to build up, ideally, six months worth of living costs along way off that at the moment. I’ll get there. This is for some small things like car insurance and Christmas. I think a mistake that I used to make and a lot of people make, is they put savings into one big like blob without any purpose. And then it means that there’s not really any consequence of thought if you have to withdraw from it. Whereas what I’m trying to do is have a plan for everything that I’m taking out of my budget.

Abdul: No, I think that’s good. Emergency funds have been something that’s come up quite a lot on this series so I think it’s great that you’re talking about it. But when you are deciding to save and invest, what are the key things that you consider?

Clare Seal: I’m very much a beginner investor. At the moment, I’m just sort of having a look at the functionality on the savings apps that I use. And so seeing what the returns on different funds are in just having a bit of fun with it. But over the next year, as we have a bit more disposable income to invest and we’re starting to think more about the long term. Rather than the short term pay-off-debt-save-house-deposit. I’m definitely going to be looking into that. I think there’s so much great content on Instagram, even about investing for beginners and value investing. I really had this attitude, until very recently, that investing was only for rich people and financial advisors only for rich people. It just isn’t, is not the case. So yeah, I think I’m just at the stage of like dipping my toe in the water at the moment.

Abdul: I had the same opinion. Before I joined with Claro, I also thought investments were for rich people and if you don’t have the funds it’s not for you. But no matter where you are, in terms of if you’ve got a lot of money or if you don’t have much, there are things you can do to make sure that you’re in a better position financially. I was going to ask, are risk and potential return something that is key to your decision making?

Clare Seal: I have gone for lower risk bundles at the moment, just because I still am not sure if I’m gonna need to access that money at reasonably short notice. And I think once they get a bit more comfortable and are a bit more on a level playing field that I’ll be able to take a bit more risk. But and it’s really interesting seeing how fun global events affect how prosperous, different funds are. It’s quite fascinating. But, for me, it’s kind of low risk, low reward. And as we start to look more like long term stuff, I think we’ll start to get riskier, and we still have sort of higher reward.

Abdul: We actually made a risk quiz at Claro. So if anyone’s interested, take the quiz here. It’s not necessarily a bad thing if you don’t want to take much risk, there are still products available. So if anyone’s interested in that – take the quiz, I just learned a lot myself doing it. And at Claro, we are really focused on more of the ethical side of investment and the impact your decisions make globally and within a company. So are there certain values that you take into consideration while investing or thinking about certain products?

Clare Seal: Yeah, that’s definitely a priority for me. I am quite conscious of my purchasing decisions from a financial perspective but also from thinking about climate change and human rights. All of that stuff. It’s something I’ve become more and more aware of like the last couple of years and so there’s no point in me doing all of that and then investing in something that pulls that out. And I think it’s something that really needs a bit of light shone on it. I think actually, for instance, with some investment providers might go for that “Green Fund“. But if you look at who funding is funding it, it’s Boohoo, who are not green in terms of the environment, or in terms of human rights. As you say, having transparency and that visibility enables people to make an informed decision on where their money is.

Abdul: Yeah, I think when people think of more ethical products they automatically go to like green products which is a huge part of climate change but there’s also other things to consider. I know people are becoming more socially aware of what’s happening within the world, and it’s really important to look into these businesses a little bit more and just consider that actually, you may be one person but you are creating an impact. So before we leave, I would love to know what’s your top money saving tip?

Clare Seal: I think at the moment, I would recommend doing an audit of your finances. It’s really easy to bury your head in the sand as everything is a little bit depressing with COVID. We don’t know when it’s going to be over. And I certainly know that feeling of everything feels like it’s not going great. But the worst thing to do is to try and ignore it for a second. I think trying to make sure that you have the ability to budget so you can save something is important. Making sure you look after your money, as it’s an important element of looking after yourself.

Abdul: Finally, where can we find you and what projects are you working on right now?

Clare Seal: Yes, so you can find me @myfrugalyear on Instagram. I am also currently doing a soft launch for my new website, hopefully, next week – if everything’s ready! And that’s all on me. And then my book Real Life Money which is out now! I also have The Real Life Money journal which is out in December.

Abdul: That’s amazing. Thank you so much for joining me today. It was really lovely talking to you and good luck with your future projects!

Clare Seal: Thanks so much, Abdul. Bye.

This information is for illustrative purposes only and it should not be construed as financial advice. When investing, your capital is at risk.

Tags: abdulasks