Personal Finance is just that, it’s personal! So everyone has a unique story to share and there isn’t a one-fits-all solution. Today we are joined by Gaby Mendes (@Iamgabymendes) who talks about how she was able to buy her new home and exciting new projects to help support first-time buyers.

Abdul: If you have been following our instragram live series, you’ll know who our guest is this week. But I’m going to let her introduce herself! Hi Gaby, how are you doing?

Gaby Mendes: Hi, I’m good. Thank you.

Abdul: This is a take two because of the tech difficulties. So thank you for coming on again. I’m just going to let you introduce yourself to our audience.

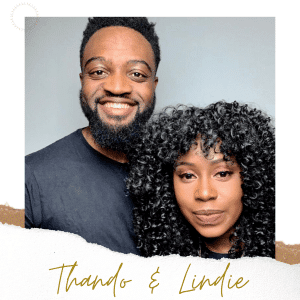

Gaby Mendes: So my name’s Gaby Mendes, I’m the founder of @TalkTwenties which is a platform that exists to kind of support you throughout your adult life – to kind of discover all those things that we didn’t get taught in school, but you know, would be relevant to the outside world.

So we do all kinds of stuff that is relevant to someone in their twenties. And one of those things that we like to cover is personal finance, which is why we love teaming up with you guys. You think it’s really important to be able to manage your money better and you know, you don’t really learn these things in school. So, that’s where I’m coming from. Other than that, I’m 25. I live in the Northwest of England with my boyfriend, and yeah, work full time and this is my business as well. So yeah.

Abdul: Great. So tell us what your financial goals are at the minute.

Gaby Mendes: Well we just purchased this house 12 months ago. It’s in need of a brand new bathroom. So, we’ve been spending the last few weeks, looking for tiles and so many things. Grown-up things, that I never thought I’d ever had an interest in. We’re currently working towards that and it’s happening at the end of October. So it’s quite a big project that we’ve currently got, that we’re working on.

Then personally, I’m trying to build an emergency fund for myself because I think given everything that’s happened with coronavirus. Thankfully, my job is okay, but you just don’t know what the future’s going to look like. I’m trying to build a bit of an emergency fund, so that if anything worse happens to my job or if something happens to a family member and I have to take care of them or anything like that. I would have a bit of money set aside to tide me over for a couple of months.

Abdul: Well, congrats on your new home! That sounds very exciting. It’s interesting that you bring emergency funds in the conversation because it’s hard to gauge the timeline for that. It’s a constant thing as you don’t know when you’ll need it. But do you have any timelines for your goals?

Gaby Mendes: For the bathroom, it’s kind of almost imminent, so it’s coming off the end of October. So we’re kind of in the stage of spending that money, which is a nice place to be. We’ve have done a lot of the savings for this and then we’re just purchasing things at the moment. I guess, what we will have to do, is pay for all the labor and things. There’s still money going aside from our income for that but the majority of it is has been saved. We’re probably nearing the end of that light at the tunnel. I’ve got a target of what I want to hit and when I hit that, I’ll probably consider the next timeline.

Abdul: That’s cool. And with these timelines, how are you allocating your savings to meet these goals?

Gaby Mendes: Yeah, definitely. I managed my finances at the beginning of every month whenever I get paid. As soon as I get paid, I have various different pots that I put my money into. I have a bills account where we pay the mortgage, you pay for like water and food, etc. My boyfriend and I both pay into that account. And then I have other accounts like for a holiday fund, emergency fund, and the bathroom fund. All these different pots of money and I like to divide it up. As soon as I get paid, I leave myself with a bit of leeway. So, you know, if I want to go out with that friend or if I want to go somewhere, I’ve got a little bit of cash to play with.

If anything happens, unexpectedly, within that month, I usually factor into my next month but I know my credit. Last month my car needed four new tires, I wasn’t expecting that and I hadn’t budgeted for it. I could have gone into my emergency funds if I wanted to. But instead, it’s not too much that I can’t factor that into my month’s savings. It probably is best that I have an emergency fund, but I’ll use the money that I’ve got coming in next month. So I try and divide it up that way.

Abdul: Ahh okay. When you’re deciding to save and invest, how do you make those decisions?

Gaby Mendes: For me, I’d probably say it depends on how much access I wanted for this money. For things that I know I’m going to need to have immediate access to, I’ll initially use something that’s probably quite easy to get in and out of. But for example, my emergency fund, I deliberately want it shuts away – I want it to be really hard to access. So I deliberately have chosen an account that takes like, a massive pin code or has many passwords to get in, because I want to have those barriers. I don’t want to be able to access that money easily. Whenever I need it because I don’t want to be diving in unless it’s like an absolute emergency.

In both parts, it helps me know what I’m going to do with that money. And that is a big deciding factor to know if this is a little pot that I want to put some money aside, but I want to be able to get to easily. So many different reasons but I definitely think accessibility is one of those things. Bearing that in mind because I was putting the money away for my house, we knew that we could only withdraw that money. When we bought a house, we then chose a specific type of ISA. I think just knowing what you can and can’t do with an account is probably the biggest deciding factor for me.

Abdul: I think that ties into the next question that I had – do you ever look at risk and potential return when you’re making financial decisions?

Gaby Mendes: Well, buying a house to a certain extent is a risk because how the property market is going. Your house might be worth one price one day and then the propertyy market might dip and it might not be worth the same amount. So I would probably say that’s probably the biggest risk. Financially and in terms of investments, I feel like it’s something that you kind of grow into.

I’m always talking about life and being in your twenties, but I think you kind of grow into as you grow and develop on personal level. We may think “I can risk this much” when you’re first starting out in your career. Every single pound means something to you and you probably know that most of it’s going to go towards bills and stuff like that. Just finding your feet in the world, you just want to make ends meet initially and then once you get past that stage, fingers crossed, and you are making a bit of an additional income you could spend money on other things.

That’s when you can start to factor in, “how much am I willing to willing to risk in order to make for a potential greater investment in the future?” I think that kind of growth is probably where I am moving towards right now. Definitely, the house was the first step and now hopefully setting up more investment accounts to do more with my money will be great.

Abdul: Okay. So are there any values that influence where you invest your money? Is there something that you’re passionate about and has that changed over the years?

Gaby Mendes: Not necessarily, I think for me, it’s just knowing that what I’m doing with my money makes sense to me. And not something somebody else’s has told me that I should do. That’s because I think accepting advice from like financial advisors and things like that, they can obviously push you in a direction that. They might give some feedback that is absolutely wonderful, but it’s gotta be you. And I think you can only do what you feel comfortable with.

When you’re starting with finances, it’s a personal thing and what you do with your money is entirely up to you. So I think obviously financial advisors are great and they’re there to guide you, but it’s got to be based on what you feel is the right decision for you. If you are holding you back, then you need to tell yourself, why am I? But why am I questioning myself or why am I not? Base your decision on what you believe in.

Abdul: I almost feel like you just gave a pitch of our company without doing a cheeky plug… Thanks Gaby Mendes! One last question that we ask everyone is what is your money-saving top tip?

Gaby Mendes: Yeah, definitely. So my tip is 100% – divide and conquer. I have a lot of different accounts and each one has a purpose or a reason why I have it. When I get paid each month, it fluctuates depending on what my income is or whether it’s near Christmas, birthdays, that sort of thing. So I divide it up and I put my money into different pots and accounts. And then I get to spend a pot of money. It’s the most exciting thing! It ends up with me thinking “I didn’t even know I had this”. But I’ve been paying into it for six months and it feels great because I’m not having to force myself to think I’ve saved for this.

So for me, dividing something up on the day I get paid is the best way that I can handle my finances. I feel like that is probably the best tip I could give anyone. And it’s a personal one, so if you divide it up however it feels best for you Really really helps me. So definitely do it.

Abdul: Great. I know you have your @talktwenties podcasts, so if people want to check that out, they can find you on social media. But what would be your favourite resource that’s helped you in your financial journey?

Gaby Mendes: Definitely. Mine’s going to be a book. The book, “Rich Dad, Poor Dad” completely changed my mindset on how I think about money and how I think about the way we work for income. Just how the world works in terms of finance. So I read that book and I passed it on to my boyfriend. He was like, wow, this book is amazing! And now he’s like the biggest fan and listens to Robert Kiyosaki’s podcast, “your failures”.

But honestly that book helped us, it helped us to prepare to buy a house. It talks about assets and tips for if you want to own something of your own or if you want to do things with your money. My parents hadn’t ingrained any of those things, thoughts or behaviors. So probably the way that I handle my money is quite different from them. That book was probably the biggest mindset change for me and I’d recommend it to anyone. And I must’ve read it when I was about 22. So I think it’s a really good book if you’re open-minded and want to grow and learn a bit more about money.

Abdul: It sounds fantastic. I’m definitely gonna check out! I know you’re super busy, but are there any current projects that you’re working on that you’d like to share with us?

Gaby: I’m working on a project with Serena, who is a mortgage advisor. We are doing an online course for first-time buyers to support you with your home buying journey. So she’s going to be bringing some knowledge and with my experience as a recent first-time buyer.

When I bought my first home, it was so hard to know all the steps of buying your first house. What you need to know, what’s this and what’s that. We missed out on the first home that we wanted to go for, because we just weren’t educated enough. We didn’t have enough information about buying a house and we made mistakes. Stupidly, we didn’t put an offer at the right time and we just didn’t know what we were doing. And I wish I’d had this tool as it could have taught me how to do this earlier. So that’s starting on the 1st of October. I’m really, really, really excited – keep an eye out for me in your local bookshop!

Abdul: Amazing. I’ll definitely be checking that out. Thank you so much for coming on. You can find Gaby at @Iamgabymendes. You can also find us at @Claro_money. Do check us out and we’ll see you next week. Thank you, Gaby.

Gaby Mendes: Thank you, bye.

This information is for illustrative purposes only and it should not be construed as financial advice. When investing, your capital is at risk.

Tags: abdulasks