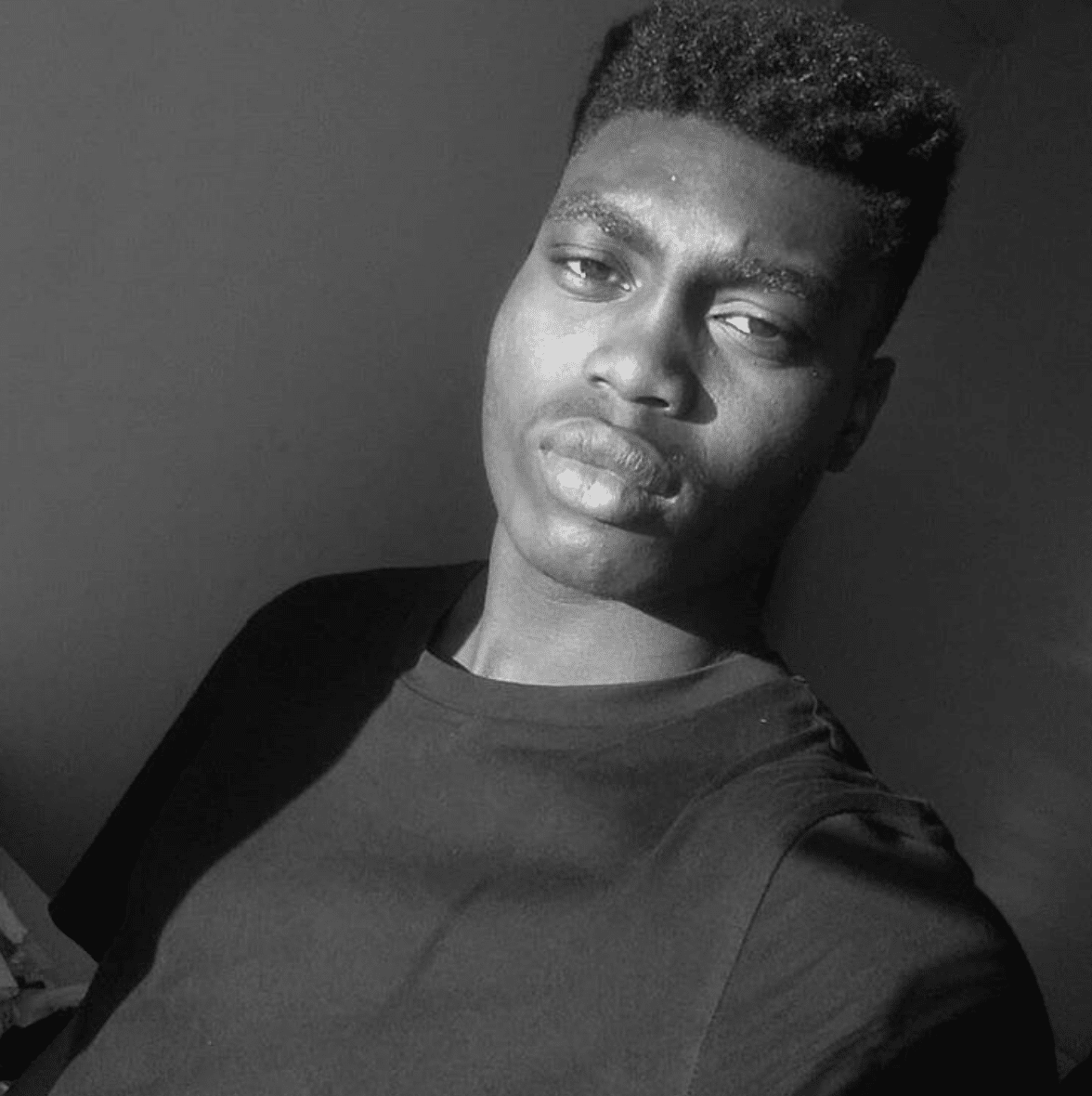

We’re back again for another episode of Abdul Asks, and if you’re new to the channel, this is a new series where we’ll be meeting members of our community, experts, and influencers at different points in their financial journey. The purpose is to help you understand more about saving and investments. Last week, our guest was our Chartered Financial Planner, Rachel, and she gave us some great insights into how she deals with her personal finances. Today’s guest is Kia Commodore from the Pennies to Pounds podcast.

Abdul: Hey Kia, how’s it going?

Kia: I’m good thanks, how are you?

Abdul: I’m great! And thank you for joining us today on the show. Please introduce yourself to our audience. I’m sure they know who you are already, but let’s hand it over to you.

Kia: So my name is Kia or you can call me Kae. I am a personal finance influencer. Personally, I have my own podcasting platform, called Pennies to Pounds. And here we are! And I’m also on the BBC5 Live podcast, “Your Work, Your Money”. So that’s what I do.

Abdul: Amazing. Well, we’ll get straight into the questions. Tell us what your current financial goals are at the minute?

Kia: My goal is, at the moment – well my biggest goal is to try and save for my first house. So I’ve not long finished uni, obviously, I have a recent graduate lifestyle but I’m trying to save up for my first house. That’s where my goals are directed at the moment.

Abdul: And do you have timelines to reach these? You know, short term, mid term, long term goals.

Kia: So, short term, I guess saving-wise, my goal is to get a new car. So that’s crucial. It will be in the next year or two, hopefully. For the midterm goal, it would be my first house. I hope that will be in the next five years. My dad said not three but I’m going to give myself five to hopefully get my first house. And then long term, after that my goal will be for my pension. I want to make sure I can retire comfortably. I don’t want to be scrambling for change when I’m older (hence choosing the name Pennies to Pounds for my podcast). And I’ve worked for many years now.

Abdul: Given these timelines, have you allocated your savings to these goals? Are you working towards making sure that you’re spending in a way that you can reach these goals?

Kia: My short term goal is to get a new car. So as much as it’s not my priority when it comes to saving, I do put money away for it. But again, if it doesn’t happen in my timeframe, then that’s fine. But my house is where my saving, all my money, is going towards. I obviously contribute money towards my savings – got my government-funded saving accounts. I have been tracking my spending because that is where I’m notorious for losing money. So I’m trying to figure out where I can kind of pull back the money and put the extra money that I don’t spend into my savings. And then like I said, when I was working, I was contributing towards my workplace pension. And obviously, a state pension is given to you.

Abdul : Yeah, that’s amazing. You mentioned a little bit about deciding how you do your spending analysis, but when you do save or invest, how do you decide where to do it? Is there anything in particular you look at?

Kia: That’s a good question. For savings accounts, I have a range. I have quite a few savings accounts – about five, all kind of different. I have two which I’d say are more long term. So I have to give notice for any withdrawal which prevents me from dipping in for frivolous spending. So I have that and that’s more geared towards saving for my house.

Then I have the other three – one’s an emergency fund. But these other accounts are ones that I can just dip into it, as and when I need. If something goes wrong today, I can just dip into it.

When it comes to investing, I know a lot of people do it in different ways. I like to pick companies, or just in general, if I want to invest in funds I like to do it based on what I believe in – my ethics. For example, there could be a share, which is doing amazing and gets great returns, but if they’re harming the environment, I’m not really interested in that. So I try to pick whatever I would invest in, personally, based on my ethics. That’s because I know at the end of the day if we’re going to make money, I want it to be something that aligns to my beliefs and my morals. At the end of the day, I’m gonna have to take that money back, and I have to be comfortable with how that money was made.

Abdul: Yeah, that was actually one of our questions – how do your investments align with your values? From what you’re saying, ethics have a huge influence on where your money goes. Do you think about risk and potential returns on your investments?

Kia: It does, and I’d say when I first started investing about almost two years ago, I was trying to get to grips with how it works. Figuring out what high and low risk meant. And I remember I was looking at these different funds. I saw them and they were really high risk. I thought to myself, you know what they say, “the bigger the risk, the bigger the reward” so I threw all my money in. Well about £50 into that fund, and it completely tanked…completely tanked! And that was a valuable lesson that I learned. Which was, yes you can get high returns but at what cost? So I like to even it out.

I do invest a little bit in some higher-risk portfolios but my aim is that I want to get my money back. I want to make sure I can get back. So I now do have a mix of low-risk and high-risk investments in my portfolio. I am a bit risky, but not as risky as before. I want to mellow down because I understand more about how it works and how you should kind of diversify your portfolio in that sense.

Abdul: That’s really interesting. So, as a personal finance guru and owner of Pennies to Pounds, what would you say if someone was new to investing? What would be your money-saving top tip?

Kia: If someone’s brand new to investment, what I’d say is don’t do what I did and just jump in because it looks great. I’d say, do your research to understand “what am I investing in?” How does it work? A big thing for me is, are there any fees involved? Because some platforms have fees, some of them are hidden and some of them are upfront.

You need to know what you’re going to be paying, definitely do that research first. And there are two ways to do this. Some platforms, you can just put in monthly amounts and invest every month – sending over, let’s say £50/100 pounds for my account every month. The other option is to have a lump sum and invest that way depending on what suits you. I definitely say research all of that and figure out what’s best suited to your situation.

Abdul: I love your Pennies to Pounds platform and you’re really putting some useful information out there. Is there something that you could share with our audience that you found useful as a resource? It could be another podcast, or maybe something that helped you with your financial journey?

Kia: In terms of resources, I started listening to this podcast called “Rise at Home”. And they were great. They were three uni students who were talking about their journeys and educate you for financial literacy. So I’d follow them. If you’re someone who wants to kick it up a notch, there are so many amazing accounts on Instagram, even if you just search financial literacy, you’ll find so many accounts.

Aside from Claro and the Pennies to Pounds podcast , there are loads of accounts. I’d say, surround yourself and fill up your social media with what you want to become or what you want for your life. So if you really want to improve your finances, surround yourself with financial literacy, if you really want to be great sports, follow sports, people, whatever it will curate your social media journey based on what you want to achieve.

Abdul: Amazing advice. Finally, what are you working on currently? We know where to find you on social media. But are there any new upcoming projects you’ve got going on?

Kia: Oooh, well next month in October, it’s the one-year anniversary of Pennies to Pounds. So I’m keeping somethings under wraps, but I will say October is going to be a good month for content. I’m kind of putting things in the works to commemorate our first year.

Abdul: Congratulations on your first year! Thank you for joining us and it’s been a pleasure talking to you, as usual. If you really want to upscale your financial knowledge, follow us at @Claro_Money on instagram. You can also find Kia on instagram at Pennies to Pounds. Looking forward to seeing you celebrate your full year!

Kia: Thank you! Bye

This information is for illustrative purposes only and it should not be construed as financial advice. When investing, your capital is at risk.

Tags: abdulasks