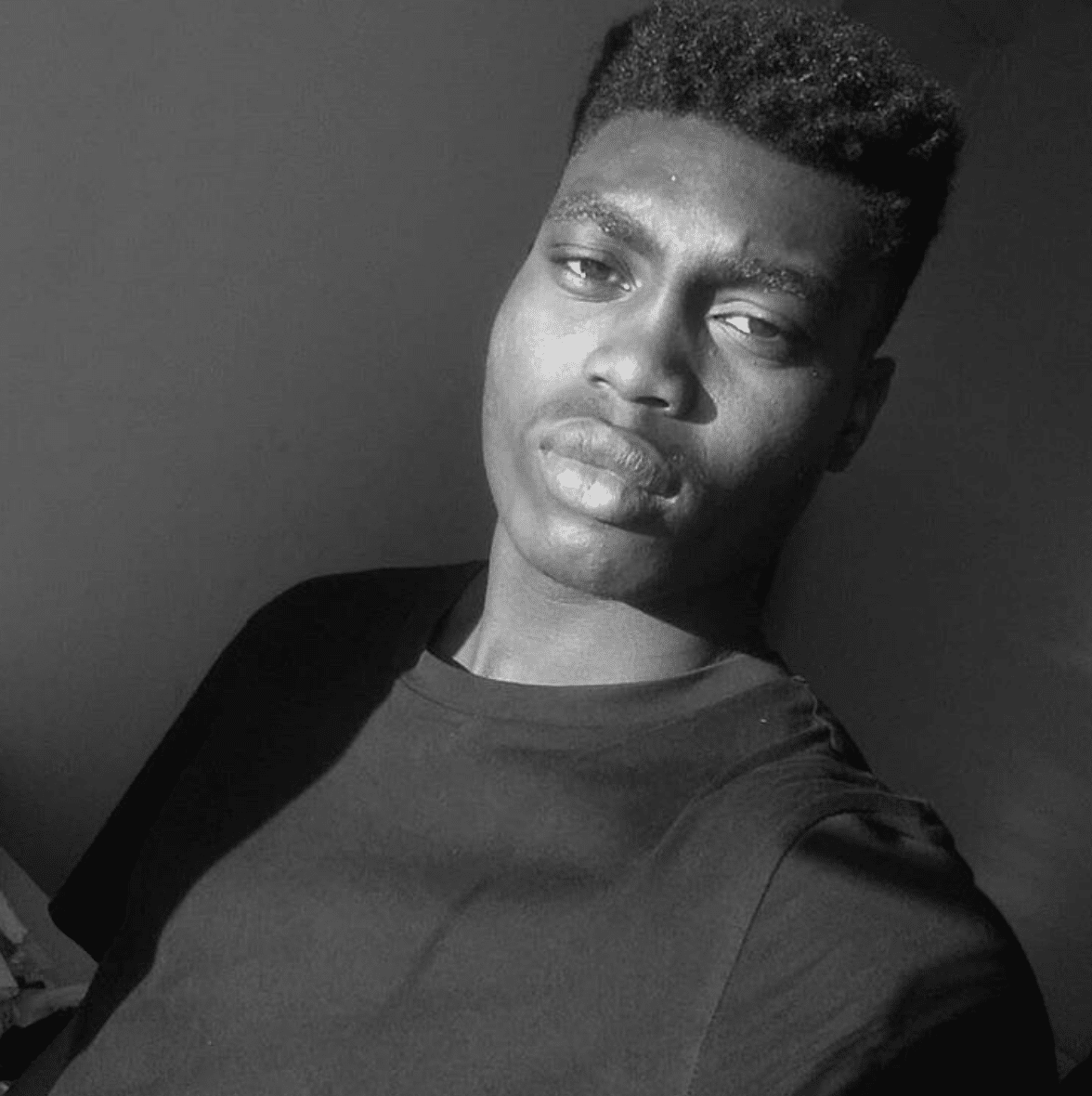

Today we’re talking to money mindset influencer Gordon Torks about his personal finance journey and how he deals with goal timelines.

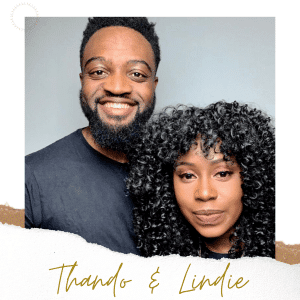

Abdul: Hi, everyone, this is Abdul – the Community and Social Media Manager here at Claro. Welcome to the Abdul Ask Series – we have a special guest joining us shortly. But if you’re new to Claro, we’re a digital financial coach and community, with a focus on empowering people to make smarter financial decisions. Our guest today is Gordon. How are you doing?

Gordon Torks: I’m very well, how are you?

Abdul: Good thanks! So, I’m gonna let you introduce yourself to our audience…

Gordon Torks: I’m Gordon Torkornoo and I speak about finance, I guess. I’m just someone who’s, just like everyone else, is trying to make a way in this world. And trying to achieve financial freedom, which I think is everyone’s goal in the end. And I do this through various means of side hustles. But, I still work a nine to five. So yeah, just your average guy, I guess, trying to make his way into this world.

Abdul: Amazing. Well, let’s start with our first question. A lot of the questions we get in our community are about trying to understand people’s financial goals. So what are your current financial goals?

Gordon Torks: So I have three financial goals, short term, long term, medium term, and long term, my short term goal is a span of one to three months. And that’s just to not get into any bad debt. So I made me to just not take out any loans or anything stupid and stuff. The way I plan to achieve this is through something I call the money mindset. So as to make sure that my mindset around money is strong enough to not ever put myself in a position to have to get a big loan so that means not taking huge risks with my money.

So that’s my short term goal, my medium term goal was to increase my emergency fund to a year’s worth of savings, obviously, because Coronavirus and people getting laid off and stuff, I think it’s very important for us to make sure that we have an even bigger buffer. And we were locked down for so long. And you know, people weren’t working. In that time, and luckily, I was, but next time, it could be me not working for all those months. For me, I think it’s really important to build up that emergency fund, so that if even if I wasn’t working for a year, I wouldn’t be too worried about how to pay the bills.

My long term goal (five years plus) is to eventually have my dividends, payments, paying for a substantial amount of my monthly expenses. So it’s gonna take a while to build up.

Abdul: Amazing, it’s been a year thinking into that timeline way of things. And with the timelines that you’ve set yourself, how do you currently allocate your savings against these goals?

Gordon Torks: Obviously, my aim is to increase my income. But in terms of savings, I just a bump up how much I save, and also with the dividend payment also bump up how much I invest. Essentially I’m cutting down on luxury spending – eating out and stuff like that – and just reallocating that money into my emergency fund and also my long term investments. So that’s how I plan to kind of shuffle around my money.

Abdul: Great. So the purpose of an emergency fund is quite clear, you know, to use it on a rainy day. Not like today. How do you decide where you save and invest? Is there something that you really valued to put your saving and investment towards?

Gordon Torks: Yeah, so with me, I just, I look for growth, as well as security, I don’t believe in going all out in one direction or the other. So I tend to put, some of my money in stocks and ETFs. And, and then I tend to put like another percentage into high-interest savings account. I have the security with the high-interest savings account. And then I have the potential to grow that money with stocks, but obviously that comes with risk. Hence I like to do a split between those two avenues.

Abdul: So you’re thinking about risk and potential return whenever you’re making these investments?

Gordon Torks: Yes, exactly that!

Abdul: And then how do your personal values influence your investments? We’re seeing more people becoming socially aware and in tune with more ethical products. Do you have any personal values that influence your decisions?

Gordon Torks: Definitely, for me, I’m looking towards the future and the kind of investments that can make the world better. So for example, rather than investing in companies that might be using fuel and petrol, I might invest in a company that’s more sustainable. And so just those little things, when I look through a company, I make sure that their value aligns with mine, and that they’re in the business to help the world not to take advantage of the world. So that really influences me before I do any sort of deeper analysis. I make sure that the company has a lot of the same moral values that I have, which is people over business and people over money.

Abdul: Amazing, I think that’s a great value to have. And if you had like a top money saving tip, what would it be?

Gordon Torks: It would definitely be – we hear a lot of talk about people saying that the average millionaire has seven streams of income. And that’s all great. I think some people go a bit way with trying to have so many ways in which they earn money that they kind of become deflated. That’s happened to me before. I would say that instead of going wide, go deeper. So rather than having seven streams of income that pay you X amount each month, why not focus on two or three, that gives you that same amount of money. For me, it would be less about going wider and more about going deeper, and how you earn your and your money. Focus on one thing, and then grow that in the face of nothing, rather than trying to start seven different things at once.

Abdul: I think that’s part of what we are trying to do at Claro, just making sure that people are more knowledgeable and aware of how to deal with finances because, as you mentioned, you have a good grasp of your finances now but that might not have always been the case.

Gordon Torks: definitely not!

Abdul: Exactly. So there’s a lot of jargon that goes out there. And part of what we’re trying to do is coach people in a way that they can make decisions for themselves. And without feeling overwhelmed. Before we leave, do you have any upcoming projects that you’re excited to share? And where can we find you on social media?

Gordon Torks: On social media, it’s just @gordontorks on Instagram and Twitter. I have one project that I’m really looking forward to, it’s going to be probably a five-year project, but I’m literally gonna build a house from the ground up. So that’s really exciting. I think in personal finance, once you get the foundation – once you get through that jargon- and you really understand what you’re doing, it kind of just compounds your knowledge compounds and so does your income. For me, I feel like I’m stable foundational base, which, I’m looking to use that as a springboard to increase my financial literacy and my income and reach my goals,

Abdul: That sounds like a very exciting project! And I’d recommend anyone tuning in to check your page out – you do some great money mindset motivational pieces. Thank you again for joining me today. Hopefully we’ll talk soon, and good luck with all your projects.

Gordon Torks: Thank you. It’s been great being on the show.

This information is for illustrative purposes only and it should not be construed as financial advice. When investing, your capital is at risk.

Tags: abdulasks